The Challenge

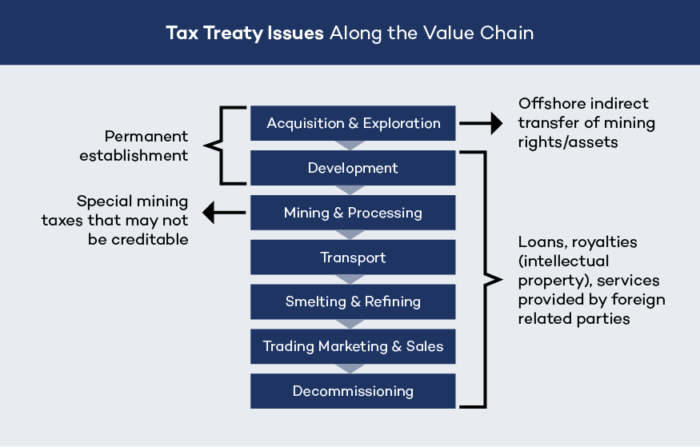

Tax treaties generally allocate taxing rights between the governments that are parties to the treaty on income from cross-border transactions.

Treaties can have a major impact on which government is entitled to collect taxes—and how much. This can affect the allocation of hundreds of millions of dollars for mining countries or for other countries related to the investor.

While governments might negotiate tax treaties to attract foreign direct investment, in some cases, companies can improperly use them to facilitate tax avoidance. Tax treaties offer a range of tax advantages, including the reduction of withholding taxes (on dividends, interest, and royalties) and a foreign tax credit or exemption to eliminate double taxation. As such, tax treaties can be viewed as tax incentives that can be exploited by tax planners.

There have been many instances of tax treaty abuse in the extractives sector where companies have used tax treaties to reduce their tax payments to governments of resource-rich developing countries. Some examples include Heritage Oil and Gas (Britain) in Uganda, Paladin Energy (Australia) in Malawi, and a Canadian subsidiary of Rio Tinto, Turquoise Hill Resources, in Mongolia.

Our Response

In November 2021, we published Protecting the Right to Tax Mining Income: Tax Treaty Practice in Mining Countries, a practice note to help government officials in resource-rich developing countries that may be deciding to adopt or renegotiate tax treaties. The publication is a practical tool to help governments protect their right to tax mining income and avoid or reduce financial risks linked to tax treaties.

We have also initiated new empirical research on tax treaty practice in the mining sector with the International Senior Lawyers Project. Our work will examine the potential impact of tax treaties on government revenues from mining, identify the treaty articles that are most relevant to the sector, and highlight the best resource-relevant treaty practices.

We have also developed a comprehensive training program on international tax treaties and the mining sector. The training covers issues such as permanent establishment, immovable property, and capital gains tax.

Want More?

- International Centre for Tax and Development — Tax Treaties Explorer

- United Nations – Handbook on Selected Issues for Taxation of the Extractive Industries by Developing Countries (Chapter II)

- International Centre for Tax and Development – ActionAid Tax Treaties Dataset

- International Monetary Fund – International Taxation and the Extractive Industries

- Organisation for Economic Co-operation and Development – Tax Treaties