As global demand for critical minerals surges due to the energy and technology transitions, resource-rich countries are seeking to harness more economic benefits from their critical minerals. While exporting mineral ores or concentrates can provide significant revenues if taxed effectively, governments are increasingly interested in value addition by processing and refining minerals in country to maximize economic returns through manufacturing and industrial development.

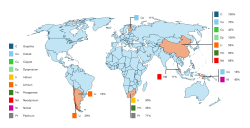

The topic of value addition often extends beyond domestic conversations into international forums, such as the principles and recommendations of the UN Secretary-General’s Panel on Critical Energy Transition Minerals and the Fourth International Conference on Financing for Development. However, many resource-rich countries have struggled to translate this ambition into sustained success. For example, an important action item in the 2009 Africa Mining Vision was the promotion of local mineral processing for use in manufacturing. Although processing facilities for minerals and metals exist throughout Africa, many African countries continue to export minerals that have undergone little processing and virtually no downstream manufacturing. When it comes to critical minerals, processing and especially large-scale refining and manufacturing capacity remains highly concentrated in select countries.

Concentration of large-scale refining capacity for selected critical minerals

The mixed outcomes of previous attempts to promote domestic value addition often stem from a failure to prioritize primary enabling conditions for investment, such as infrastructure and regulatory frameworks, over fiscal incentives. Tax incentives are usually secondary for investors, particularly in less mobile sectors such as mining. A strategic approach to tax policies, combined with enabling non-tax measures, can drive domestic value addition in critical minerals and maximize long-term economic benefits.

Ensuring primary enabling conditions are in place

Tax incentives alone have rarely been sufficient to attract substantial investment in large scale mineral processing and refining, likely due to their inability to overcome the barriers to investment faced in these activities. Primary enabling conditions are fundamental prerequisites for fostering domestic mineral value addition and the effectiveness of incentives to the extent that they are necessary to attract investment. These conditions include the following:

- A clear national policy or strategy: Countries need a well-defined critical minerals strategy that sets out national priorities for value addition and industrial development. Examples such as The Canadian Critical Minerals Strategy and Australia’s Critical Minerals Strategy 2023-2030 demonstrate efforts to clearly articulate policy signaling long-term commitment to downstream processing.

- Strong regulatory and institutional frameworks: Transparent and consistent regulatory frameworks that reflect the country’s policy choice create a transparent environment for investment. The European Union’s Critical Raw Materials Act and Indonesia’s domestic processing mandates for nickel highlight such efforts towards regulatory certainty.

- Reliable infrastructure: Infrastructure gaps–particularly in energy, transport, and water supply–have often undermined mineral value addition efforts. Interventions such as Australia’s Newcastle iron beneficiation plant show how infrastructure investment can potentially help unlock downstream processing capacity.

- Absorptive domestic market capacity: The presence of domestic demand for semi-finished and finished products creates a stronger business case for local processing, as is the case in China, with most of the refining capacity for such critical minerals as graphite, cobalt and dysprosium. Without this capacity, and unless it is feasible to connect supply chains given existing infrastructure, there is less of an economic and commercial justification for domestic processing.

- Access to finance: Securing funding for processing and refining projects is crucial. Australia’s use of intervention funds, such as the Northern Australia Infrastructure Facility, highlights how targeted financial support can be introduced to de-risk investments in critical mineral processing.

Tailoring tax incentives to national priorities and mineral-specific features

Once primary enabling conditions are in place, tax incentives can play a role in enhancing domestic value addition for critical minerals. However, their design must be carefully calibrated to national priorities, the economic characteristics of each mineral, and sound commercial justification. Different minerals present varying processing complexities, cost structures, and market dynamics, which should inform the choice of fiscal and other tools.

Common tax policy instruments to incentivize critical minerals value addition include the following:

- Royalty-based incentives: Differential royalty rates that favor processed minerals over raw minerals can encourage downstream investment but also make an otherwise simple fiscal instrument more complex. South Australia and South Africa have implemented variable royalty rates, offering lower rates on refined products compared to ores and concentrates.

- Cost-based incentives: Investment allowances, tax credits, and accelerated depreciation can reduce the capital cost burden of establishing processing facilities. Australia’s production tax credits and Zambia’s capital allowances for mineral processing illustrate the potential of these tools, especially regarding the potential advantage of protecting revenues to the state from the upstream part of the value chain.

- Profit-based incentives: Tax holidays and reduced corporate income tax rates can attract investment but require careful design to prevent tax avoidance and revenue losses. While these incentives have demonstrated limited effectiveness in attracting investment in primary industries such as mining, they have had a relatively stronger impact in secondary industries, including processing. Indonesia’s tax holiday scheme for mineral processing underlines both the opportunities and risks of this approach.

- Special economic zones (SEZs): The use of SEZs can further incentivize domestic processing. However, with the global minimum tax in effect, many of the incentives relied upon in SEZs present a revenue loss risk to countries, requiring policymakers to approach SEZs with caution.

Other policy tools include the following:

- Trade restrictions: Export restrictions or quotas on unprocessed minerals have been used to incentivize domestic processing, as seen in Indonesia’s nickel export restrictions. However, these policies must be accompanied by ancillary infrastructure investments to avoid unintended consequences such as a reduction in investment, as was the case with Indonesia’s experience with restrictions on bauxite.

Lessons from policy and practice

Case studies from countries like Indonesia, Australia, and Zambia demonstrate that tax policies can influence investment decisions, if they are carefully designed and aligned with primary enabling conditions. However, these examples also underscore the risks of poorly calibrated incentives. Export bans without complementary infrastructure investment or without an assessment of such important market conditions as ore grade, excessive tax holidays, or improperly targeted incentives can undermine domestic value addition objectives and domestic resource mobilization goals.

A key lesson is that tax incentives should be tailored not only to the type of mineral but also to the broader economic and institutional context. Governments must balance short-term revenue considerations with long-term industrial development goals. The timing and scale of financial benefits must be carefully weighed to avoid either deterring investment or generating unsustainable revenue losses. Also, governments must decide whether encouraging mineral value addition should be their focus. Their financial resources and bureaucratic capacities will mean that they have to prioritize development efforts, and mineral value addition may not be the best opportunity for industrial development, even for mineral-rich countries.

By adopting a more strategic and integrated approach to tax policy, resource-rich countries can unlock the economic potential of their critical minerals endowments while strengthening their position in global supply chains. However, success will depend on the careful sequencing of policy measures, with primary enabling conditions forming the foundation for any fiscal intervention.

This blog is an introduction to IGF’s forthcoming practice note on tax policy implementation options for value addition in critical minerals. The practice note will provide further guidance on how countries can design incentive regimes that strike a balance between revenue generation and industrial development.

Ekpen Omonbude and Kudzai Mataba are policy experts with the Tax and Sovereign Debt Program of the International Institute for Sustainable Development.